Whether finalising your firm’s accounts (profit and loss, trust accounts, subsidiary ledgers such as debtors) for the end of the financial year (EOFY) and/or resetting budgets in preparation for a restructure of the firm or simply cleaning up unused/redundant account codes, this guide will provide a clear roadmap on the steps to take.

In all cases, FilePro Support is available to assist. In the case of restructures, these can take time as they are customised to reflect the terms of each restructure, so give the team as much notice as possible.

Finalising the 2021 financial year in System Control

In the case of EOFY, FilePro allows you to continue to function following EOFY without having to carry out any specific end-of-year process.

The profit and loss balance will automatically start from zero on 1 July. At some point, however, you will want to go into System Control and finalise the 2021 financial year. This will roll forward your Balance Sheet balances and consolidate your 2021 profit and loss balance to the retained earnings account.

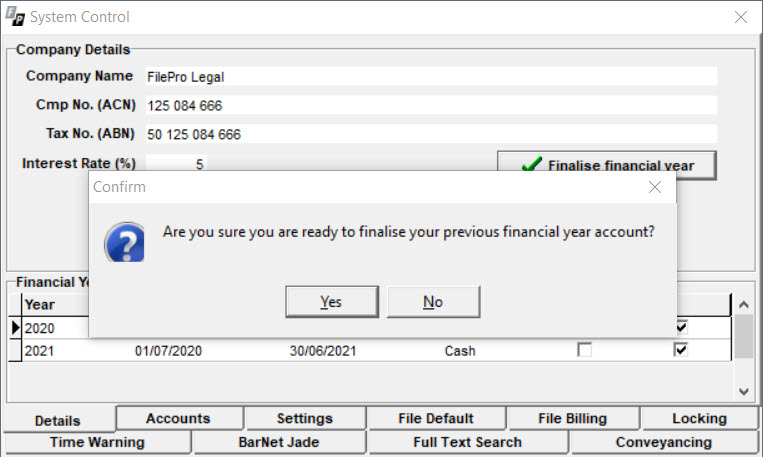

To do this, navigate to System, then System Control. After 1 July, the following message will appear:

Finalising the financial year will not lock 2021 – you can still go back and view, edit or add entries prior to the 1st July.

However, at some point (once you have finished with 2021 and printed your reports for the accountant) you should go back to the System Control screen and turn your ‘locking’ on for that period. This will ensure that nothing can be changed.

Other EOFY FilePro checks

As part of your general end-of-year practices, there are checks that you can also do within FilePro.

First, check that your subsidiary ledgers (Disbursements, Debtors, Creditors and Cashbooks) equal the closing balance of the control accounts in the general ledger. Do this by running the following reports as at 30 June 2021.

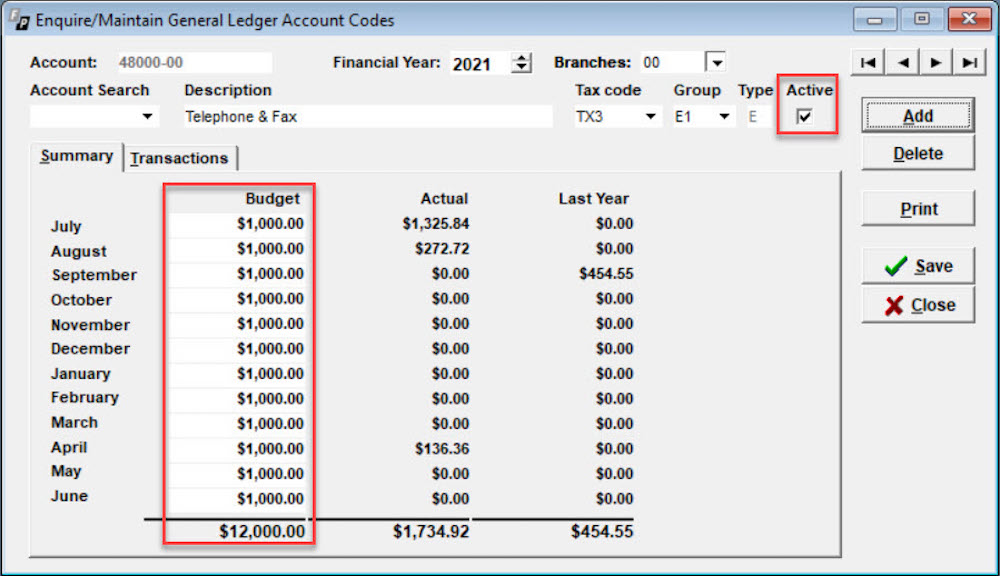

- Debtors Aged Trial Balance (Debtors>Reports)

- Creditors Aged Trial Balance (Creditors>Reports)

- Outstanding Disbursements (Disbursements>Reports)

- Bank Reconciliation Report (General>Reports)

- Trial Balance (General>Reports)

The total figures shown on each of the four reports listed should agree with the figures outlined on the trial balance. If a discrepancy is noticed, contact the FilePro Support Team who can assist with investigating any issues.

You do not need to wait until EOFY to perform these checks. This can also be a monthly procedure.

Your trust account at EOFY

The end of a trust year is very different to the end of the financial year and each state will have specific dates and procedures for the end of their trust year.

One ruling, however, does remain the same for all states. A trust account statement is to be furnished as soon as practical after the 30 June, unless:

- The account has been opened for a period of less than six months

- The balance of the account is zero and no transactions affecting the account have taken place within the previous 12 months

- A trust account statement has been furnished within the preceding 12 months and there have been no additional transactions since the date of generating that statement.

You’ll need to refer to your state’s legal governing body for further details.

FilePro has made it easy to send out your yearly trust statements. From the Trust Report menu you will have a Yearly Statements option. If you do not see this option, log into the system as System Administrator and you will be able to run the reports.

Saving EOFY financial reports

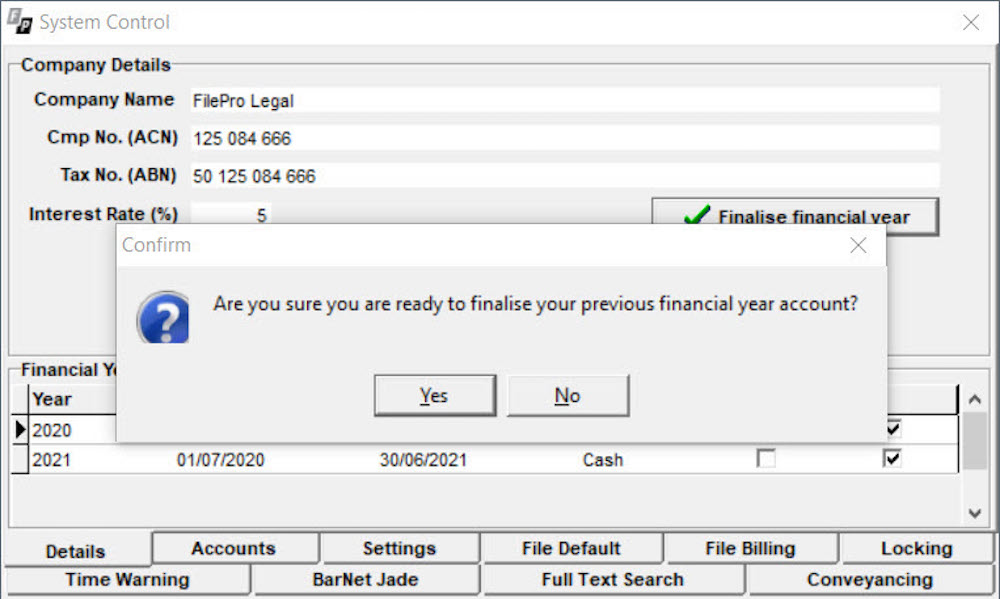

Reports generated by FilePro can not only be previewed or printed, but are also able to be saved as a file or emailed directly as a PDF. When saving, there are a few options to choose from, including Excel format. This allows you to easily send data to your accountant at EOFY and create specialised Excel reports from the reports within FilePro.

Simply click “Save As” to save the report in Excel format to the relevant folder. Alternatively, use the dropdown area to easily email a PDF to your accountant.

Managing account codes and general ledger budgets

EOFY is often the perfect time to clean up any unused account codes.

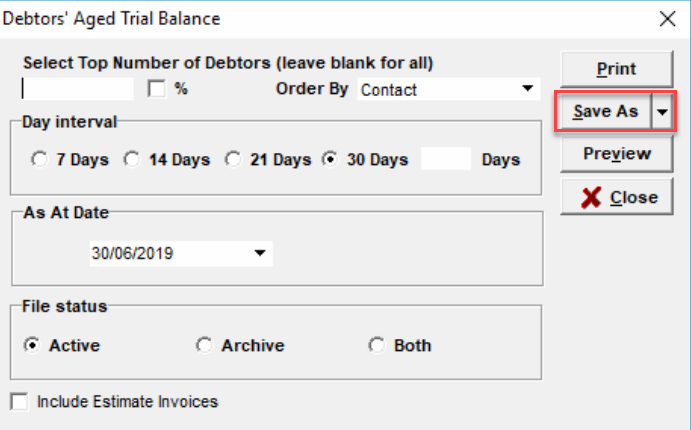

We often see account codes labelled in the following way: “Provision for Rounding – DO NOT USE”. Rather than having to do this, did you know you can deactivate account codes you no longer use? These items will still be referenced in reports if they have data associated with them, however they will no longer be available when entering new data.

To deactivate account codes navigate to General, thenE/M General Ledger, then E/M Account Codes. Select your account code, then uncheck the box as shown below.

If you want to completely remove account codes from your system, contact the FilePro Support Team.

Budgets for general ledger account codes will often need to be updated with new figures for the new financial year. When using this feature you can then generate a Profit and Loss report to include budget figures, either with “Year to Date” or “Month to Date”. This allows for a comparison of the firm’s actuals to budget.

Budgets are handled in the same screen shown above. Navigate to the relevant account codes and enter the monthly budgets in as shown. If using branches, ensure you are on the correct branch.

Need more help?

Please contact the FilePro Support Team if you would like more information on any of these topics.